March 2, 2015

A reader asks, “My partner had a 642 and i have a 517. I have messed up in the past with my credit,but i am now paying off what i have on my credit report. Would we be able to get a home loan with these scores?”

A reader asks, “My partner had a 642 and i have a 517. I have messed up in the past with my credit,but i am now paying off what i have on my credit report. Would we be able to get a home loan with these scores?”

That would depend on the standards of the individual lender. FHA loan rules state that borrowers below a certain FICO score are not eligible for maximum FHA loan financing (which requires the borrower to put down a minimum cash investment of 3.5%).

Here’s what the FHA official site says about circumstances like the one in the reader question:

“When a credit score is available, it must be used to determine eligibility for FHA insured financing. The score that is used to determine eligibility is called the ‘decision credit score.

When the credit report reflects:

• 3 credit scores (one from each repository) – the middle score is used

• 2 credit scores – the lower of the two scores is used

• 1 credit score – that score is used

MULTIPLE BORROWERS

If there is more than one borrower, the lender must:

1. Determine the decision credit score for each borrower

2. Select the lower score (or lowest score if more than two borrowers)”

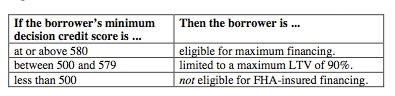

The FHA has a chart that lays out FICO score minimum requirements as stated by the FHA:

The lender is free to require higher FICO scores than the chart lists here, so borrowers who find themselves in a position similar to the reader’s should call the FHA directly at 1-800 CALL FHA and request a referral to an FHA/HUD approved housing counselor who can help with advice on improving creditworthiness and preparing for an FHA home loan.

FICO standards will vary from lender to lender, so shopping around for a financial institution is definitely a good idea. Borrowers with FICO scores on the margins of what the lender will accept may be asked to provide a higher down payment, document “compensating factors” such as substantial cash reserves or investments, etc.

Do you have questions about FHA home loans? Ask us in the comments section.