December 21, 2012

When you want to buy a home with an FHA loan, unless you’re having a house built to spec, chances are good that appliances like a washer/dryer, stove, refrigerator and other items could be included in the purchase.

In some cases this is not a problem, but depending on what the buyer and seller agree will “come with the house” as part of the purchase, could such items reduce the amount of your FHA loan?

There’s an FHA loan rule about something known as an “inducement to purchase”. A seller is permitted to make a contribution to some financial aspects of the FHA loan (but not the down payment) in order to make the deal more attractive.

Those contributions are limited as part of “the six percent rule”. According to FHA loan rules, a third party may offer “up to six percent of the lesser of the property’s sales price or the appraised value toward the buyer’s closing costs, prepaid expenses, discount points and other financing concessions.”

But elsewhere in the FHA loan rulebook, there are controls placed on what the seller may offer. “Personal property given by a seller and/or another interested third party to consummate the sale of a property results in a reduction in the mortgage amount. The value of the item(s) must be deducted from the lesser of the sales price or appraised value of the property before applying the LTV factor.”

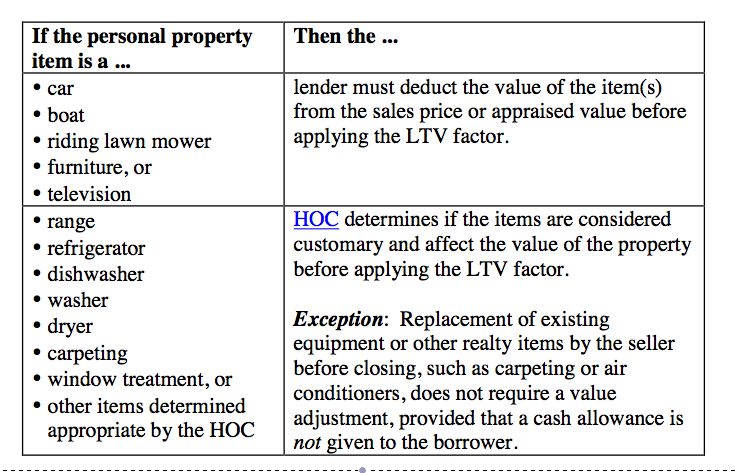

Does that rule apply to ALL personal property like a stove, a dishwasher or other appliances? Not necessarily. FHA loan rules say, “Depending on local custom or law, certain items may be considered part of the real estate transaction with no adjustment to the sales price or appraised value. The table below describes how to determine if personal property affects the sales price or appraised value.”

These rules are found in HUD 4155.1 Chapter Two, Section A, which also provides a handy table to show what may or may not reduce the amount of an FHA loan in this area:

If you are not sure whether your situation is affected by these rules, discuss your transaction with the FHA directly by calling 1-800 CALL FHA. You can also discuss it with your loan officer, who can explain what is typical in your housing market and what may required an adjustment of the loan amount.

Got questions on how FHA loans work? Ask us in the comments section.