June 13, 2018

Is there such a thing as a refund for FHA Up-Front Mortgage Insurance or FHA UFMIP? This mortgage insurance premium is required on FHA loan transactions and must be paid either in cash at closing time or must be financed into the loan amount.

FHA loan rules do not allow a borrower to pay a portion and finance a portion of the FHA UFMIP, it must be paid in full using financing or cash.

Borrowers have many questions about this FHA mortgage insurance requirement, including whether or not a refund is possible under the right circumstances.

FHA forward mortgages require UFMIP as a condition of the loan no matter if the transaction is an FHA One-Time Close construction loan, existing construction purchase, or whether the borrower is buying a manufactured home or mobile home.

The rules for UFMIP including the refund issue are found in the FHA loan handbook, HUD 4000.1, which instructs the lender that refunds ARE possible if the borrower is refinancing an FHA mortgage to another FHA mortgage within a specific time frame.

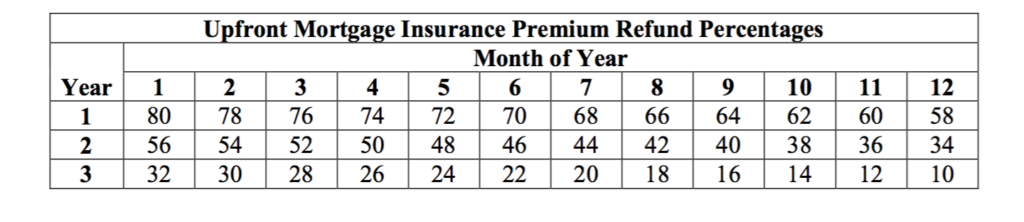

“If the Borrower is refinancing their current FHA-insured Mortgage to another FHA- insured Mortgage within 3 years, a refund credit is applied to reduce the amount of the Upfront Mortgage Insurance Premium (UFMIP) paid on the refinanced Mortgage, according to the refund schedule…”

Note that any UFMIP refund does not result in cash back to the borrower, but rather is applied as a credit. Borrowers should not expect cash back on an FHA refinance loan unless that loan is specifically designed to provide cash to the borrower at closing time.

These restrictions on cash back to the borrower are consistent through the FHA loan rules-cash back to the borrower is restricted to specific circumstances including legitimate refunds and FHA refinance loans and/or reverse mortgages designed to convert a home’s equity into cash for the borrower.

HUD 4000.1 does not make statements about UFMIP refunds for borrowers refinancing to a non-FHA mortgage loans.

Here is the FHA UFMIP refund table as it appears in HUD 4000.1. Note that the refund amounts are listed in percentages based on the year and month (see above) the refund is applicable.

Lender requirements, state law, and other regulations may affect this procedure. Discuss your questions with a loan officer if you aren’t sure how the FHA UFMIP refund rules apply to your FHA mortgage transaction.