December 24, 2013

A reader asks, “I noticed that to be eligible for an FHA loan your score must be at least at a 580. Is this true? I was told this is just something you show here on your site but once you really go through the process its a whole different story. I’m looking to buy my 1st home and I want to be told what’s right as to what’s wrong.”

A reader asks, “I noticed that to be eligible for an FHA loan your score must be at least at a 580. Is this true? I was told this is just something you show here on your site but once you really go through the process its a whole different story. I’m looking to buy my 1st home and I want to be told what’s right as to what’s wrong.”

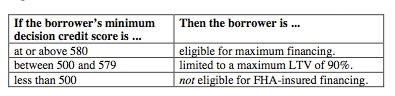

FHA loan FICO score requirements, as listen in HUD 4155.1, are as follows:

That is an exact duplicate of the table found in HUD 4155.1. The basic answer to the reader question is that according to FHA loan rules, any borrower with a credit score above 500 is technically eligible for some kind of FHA guaranteed home loan. However, these scrores are only the FHA minimums. A participating lender is free to require a higher credit score in order to be approved for financing.

What does this mean?

The participating lender you choose may require a higher FICO score than the FHA loan minimum. If the bare minimum to qualify for some kind of FHA guaranteed financing is 500 or above, but the lender’s requirements state that no loan can be approved for a borrower with credit scores below 640, the lender has set a higher FICO score standard than the FHA minimum. This is permitted

Because the FHA loan program is voluntary and participating lenders choose to do business with FHA mortgages, the FHA and HUD cannot force the lender to approve loans for borrowers who do not meet the financial institution’s credit standards.

Your experience may vary from lender to lender–some banks may be perfectly willing to work with you, while others may have standards that are quite high. It’s best to shop around for the most advantageous FHA loan terms and conditions you can find. It’s never safe to assume that just because one bank will or will not work with you, a better deal might not be available elsewhere.

Do you have questions about FHA home loans? Ask us in the comments section. You can apply or get pre-approved for an FHA loan at www.FHA.com, a private company and not a government website.